Explore content

7-10 Economics and Business

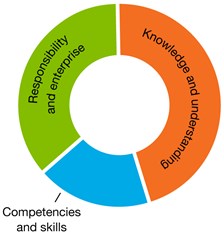

The Australian Curriculum: Economics and Business is uniquely positioned to develop consumer and financial literacy in young people. The curriculum supports the development of the dimensions of consumer and financial literacy as shown in the diagram below.

Approximate proportion of the dimensions addressed in 7-10 Economics and Business

Consumer and financial literacy is one of the key organising ideas of this subject. Students learn about the importance of financial planning, the rights and responsibilities of consumers and businesses, how people manage financial risks and rewards, the factors that influence major consumer decisions and the short- and long-term effects of those decisions. Students have opportunities to explore laws, regulations, rights and responsibilities associated with work and work futures, including the role and purpose of tax and superannuation. Economics and Business also introduces students to the structure and management of the economy and its resources and the issues and challenges of global economic interdependence. Developing an understanding of fundamental economic and business concepts enables young people to be informed decision-makers, responsible consumers and financially confident citizens.

The study of Economics and Business also supports the development of competencies and skills that can be applied in real-world consumer and financial contexts. For example, the ability to analyse data, explain cause and effect relationships, make predictions and communicate reasoned arguments enables students to make informed choices when purchasing goods and services, deciding on investment options and identifying the differences between ‘good’ and ‘bad’ debt.

In Economics and Business, students develop enterprising skills through investigations and creative activities such as fundraising events or business ventures. Making decisions based on an assessment of the costs and benefits of alternative choices prepares students to apply informed and assertive decision-making in a range of real-world contexts. By exploring the intended and unintended consequences of their decisions, students are also equipped with the skills to reflect on the appropriateness of their initiatives.

The Moneysmart for teachers and Tax, Super and You resources provide a number of interdisciplinary units that either focus on or include aspects of the Economics and Business curriculum. Access a list of relevant resources linked to the Australian Curriculum: Economics and Business using the right-hand menu.

Year 7 Should I drink bottled water?

Year 7 How can we reduce our spending?

Year 8 How can we access money overseas?

Years 5-8 Digital activity – Mobile phone security

Years 7-8 Digital activity – Advertising

Years 7-8 Digital activity – Premium services

Years 7-8 Digital activity – Social media

Years 7-8 Digital activity – Consumer rights

Years 8-9 MilbaDjunga SmartMoney – Secondary unit

Year 9 How can we obtain more money?

Year 9 English – smart consumers 4 a smart future – Smart arguments

Year 9 Mathematics – smart consumers 4 a smart future – Solar sums

Year 9 Science – smart consumers 4 a smart future – My eco-kitchen rules

Year 9 Digital activity – Savvy solutions to consuming questions

Years 9-10 – MoneySmart Rookie – First car

Years 9-10 – MoneySmart Rookie – Credit and debt

Years 9-10 – MoneySmart Rookie – Mobile phone ownership

Years 9-10 – MoneySmart Rookie – Moving out of home

Years 9-10 – MoneySmart Rookie – Online financial transactions

Years 9-10 – MoneySmart Rookie – First job

Years 9-10 Digital activity – Shopping for a mobile

Years 9-10 Digital activity – Online shopping and banking

Year 10 Reaching goals: What’s involved?

Year 10 English – smart consumers 4 a smart future – Green house rules

Year 10 Mathematics – smart consumers 4 a smart future – Money matters

Year 10 Science – smart consumers 4 a smart future – Decisions by the stars

Years 7-10 - Tax 101: Activity 1 – What is tax and why do we need it?

Years 7-10 Tax 101: Activity 2 – Tax: Who, what, how and why

Years 7-10 Tax 101: Activity 3 – How is tax revenue spent?

Years 7-10 Tax 101: Activity 4 – The Budget: taxes and spending

Years 7-10 Tax 101: Activity 5 – History of tax in Australia

Years 7-10 Tax 101: Activity 6 – Role of the ATO

Years 7-10 Your Tax: Activity 1 – Income and income tax

Years 7-10 Your Tax: Activity 2 – Working and paying tax

Years 7-10 Your Tax: Activity 3 – Completing your tax return

Years 7-10 Your Tax: Activity 4 – Calculating tax due

Years 7-10 Your Tax: Activity 5 – What other taxes do I have to pay?

Years 7-10 Your Tax: Activity 6 – Fixing a tax problem

Years 7-10 Business Tax: Activity 1 – What is a business?

Years 7-10 Business Tax: Activity 2 – Business structures

Years 7-10 Business Tax: Activity 3 – Running a business: tax obligations

Years 7-10 Business Tax: Activity 4 – Explaining business taxes

Years 7-10 Business Tax: Activity 5 – The goods and services tax (GST)

Years 7-10 Business Tax: Activity 6 –How is business tax collected?

Years 7-10 Super: Activity 1 – What is superannuation?

Years 7-10 Super: Activity 2 – Where does super money come from?

Years 7-10 Super: Activity 3 – What do I need to do about super?

Years 7-10 Super: Activity 4 – How do I choose a super fund?

Years 7-10 Super: Activity 5 – Super, the ATO and you

Years 7-10 Interactive: The story of tax

Years 7-10 Interactive: Shaping the system

Years 7-10 Interactive: Tax in your community

Years 7-10 Interactive: You make the decision