Explore content

F-6/7 Humanities and Social Sciences

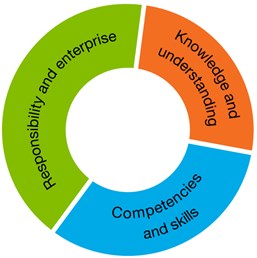

The Australian Curriculum: F–6/7 Humanities and Social Sciences (HASS) has a significant role in developing consumer and financial literacy in young people. The HASS curriculum supports the development of the dimensions of consumer and financial literacy as shown in the diagram below.

Approximate proportion of the dimensions addressed in F/6-7 Humanities and Social Sciences

Explicit links to consumer and financial literacy exist in the economics and business sub-strand of the HASS curriculum. This sub-strand is introduced in Year 5 with consumer and financial literacy as one of four key organising ideas. Here, students explore how to make informed consumer and financial decisions and consider how these decisions can affect individuals, the broader community and the environment. The other key organising ideas of economics and business support the development of consumer and financial literacy as students are introduced to basic economic concepts such as scarcity, the need to make choices, the business environment and, in Year 7, the world of work.

The knowledge and understanding that are developed in the economics and business sub-strand are supported by the content in the remaining three HASS sub-strands of civics and citizenship, geography and history, through which students learn about the importance of rules, regulations and laws which can be applied to financial contexts. Students acquire an appreciation of the role of governments in developing laws and providing services for the community’s benefit. They learn how governments gain revenue, and the responsibilities of citizens including the paying of taxes. Students begin to understand the importance of preserving places and consider how the demand for overseas goods and services can impact on people and environments. They also develop an awareness of the impact of technologies over time on the way people live and work.

Through the inquiry and skills strand of the HASS curriculum, students develop a range of competencies and skills that can be applied in consumer and financial contexts. For example, students learn to discriminate between fact and opinion when evaluating claims made in advertising, and they develop the skills to process data and analyse patterns and trends, which enables them to make reasoned financial decisions such those required when selecting investments.

By studying HASS, students also develop the skills of responsible decision-making and enterprise. The skills of enterprise are developed through student investigations and creative activities such as fundraising events or business ventures. Students learn to apply informed decision-making in a range of real-world contexts by using criteria to evaluate the advantages and disadvantages of alternative choices, leading to actions proposed in response to an issue or challenge. They also develop an appreciation of the role that values play in the decisions that people and groups make and they understand the importance of values to particular identities. The knowledge, understanding and skills that students acquire in HASS contribute to sound and informed financial decision-making throughout their lives.

Moneysmart for teachers and Tax, Super and You resources provide a number of interdisciplinary units that either focus on or include aspects of the HASS curriculum. Access a list of relevant resources that link to the Australian Curriculum: F–6/7 HASS using the right-hand menu.

Years 2-4 Digital activity – Money and people

Years 2-4 Digital activity – Money maps

Year 5 Never too young to be Moneysmart with clothes

Year 5 Hey! Let’s have a big day out!

Years 5-6 Digital activity – Calls, messaging and browsing

Years 5-6 Digital activity – Choosing a mobile plan

Years 5-6 Digital activity – Entertainment

Years 5-6 Digital activity – Mobile credit

Years 5-6 Digital activity – MilbaDjunga – Smart Money – Primary Unit

Year 6 The fun begins: Plan, budget, profit!

Year 6 It’s raining cats and dogs... and chickens?

Years 5-8 Digital activity – Mobile phone security

Year 6 Digital activity – The cost of cats and dogs…and snakes