Explore content

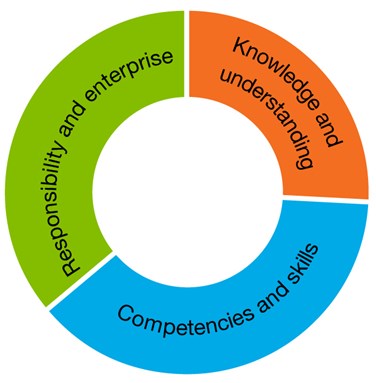

The Australian Curriculum in this year level supports the development of all dimensions of consumer and financial literacy as shown in the diagram below.

Approximate proportion of dimensions addressed in Foundation Year

Typically, at this level, students begin to develop understandings that form the foundations of consumer and financial literacy. They learn the language of number and recognise that Australian money includes notes and coins. They identify personal needs and wants and share examples of their rights and responsibilities in given situations. They explore personal and family factors that influence their behaviour.

Students begin to develop and are able to apply consumer and financial knowledge, understandings and skills in lifelike situations. They identify personal preferences and explore how emotions influence what they consume. They discuss experiences, share points of view and begin to interpret texts for purpose and message. They learn to collect, sort and present data and information in simple formats. They identify situations that involve the use of money and begin to apply enterprising behaviours and consumer and financial knowledge and skills in meaningful class activities such as investigations or special events. Students make simple financial and consumer decisions based on needs and wants.

Moneysmart for teachers provides a number of interdisciplinary units and interactive activities that support the teaching and learning of consumer and financial literacy in this year level. Access a list of relevant resources that link to the Australian Curriculum using the right-hand menu.