Explore content

Mathematics

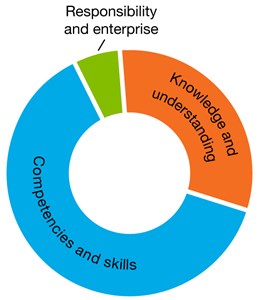

The Australian Curriculum: Mathematics has a significant role in developing consumer and financial literacy in young people. The Mathematics curriculum supports the development of the dimensions of consumer and financial literacy as shown in the diagram below.

Approximate proportion of dimensions addressed in Mathematics

Key aspects of financial mathematics are included in the money and financial mathematics sub-strand of the Mathematics curriculum. Here, students learn about the nature, forms and value of money. They learn to solve problems involving money, such as counting change; to manage money by creating budgets and financial plans; to explore and calculate percentage discounts; to work out ‘best value’ when purchasing a range of goods and services; to choose financial products and to solve problems involving profit and loss, and simple and compound interest.

Consumer and financial literacy provides a real-world context for students to learn other mathematics in the curriculum. Using authentic learning experiences engages students in mathematics, enables them to gain an understanding of a whole range of mathematical concepts and allows them to appreciate the relevance and usefulness of mathematics. The use of real-world contexts as a platform for learning mathematics also develops students’ ability to make informed judgements and effective consumer and financial decisions.

The content descriptions relevant to consumer and financial literacy are drawn from the strands number and algebra, and statistics and probability. These strands give students opportunities to ‘think and do’ mathematics in contexts that are real and engaging. For example, students might be asked to calculate the money they save by purchasing an item on sale (number and algebra); conduct an investigation into people’s purchasing preferences (statistics and probability); calculate monetary risks through the construction and use of mathematical models (number and algebra); or evaluate the benefits of insurance given the probability of an event occurring (statistics and probability).

The strand of measurement and geometry has not been included in this mapping. However, there are opportunities to include aspects of this strand in the teaching and learning of consumer and financial literacy. For example, students might compare the volume or capacity of different products to calculate best buy, or do some costings for materials, based on measurements. An example is provided in the Moneysmart for teachers unit ‘It’s raining cats and dogs ... and chickens?’, in which students explore different pet enclosures in terms of area and perimeter, using correct units.

Moneysmart for teachers and Tax, Super and You provide a number of interdisciplinary units and interactive activities that either focus on or include aspects of the Mathematics curriculum. Access a list of relevant resources that link to the Australian Curriculum: Mathematics using the right-hand menu.

Years F-2 Digital activity – Money match

Years F-2 Digital activity – Needs and want

Years F-2 Digital activity – Pay the price

Years F-2 Digital activity – Goods and services

Year 3 The house of needs and wants

Year 4 How much love can fit into a shoebox?

Years 2-4 Digital activity – Money and people

Years 2-4 Digital activity – Money maps

Years 3-4 Digital Activity – Party time

Year 5 Never too young to be Moneysmart with clothes

Year 5 Hey! Let’s have a big day out!

Digital activity – MilbaDjunga – Smart Money – Primary Unit

Year 6 The fun begins: Plan, budget, profit!

Year 6 It’s raining cats and dogs... and chickens?

Years 3-6 Digital activity – Helping out

Years 5-6 Digital activity – Calls, messaging and browsing

Years 5-6 Digital activity – Choosing a mobile plan

Years 5-6 Digital activity – Entertainment

Years 5-6 Digital activity – Fun day out

Years 5-6 Digital activity – Mobile credit

Years 5-6 Digital activity – Our-big-weekend-adventure

Years 5-8 Digital activity – Mobile phone security

Year 7 How can we reduce our spending?

Year 8 How can we access money overseas?

Years 7-8 Digital activity – Advertising

Years 7-8 Digital activity – Premium services

Years 7-8 Digital activity – Social media

Years 7-8 Digital activity – Consumer rights

Years 8-9 MilbaDjunga SmartMoney – Secondary unit

Year 9 How can we obtain more money?

Year 9 Mathematics – smart consumers 4 a smart future – Solar sums

Years 9-10 – MoneySmart Rookie – First car

Years 9-10 – MoneySmart Rookie – Credit and debt

Years 9-10 – MoneySmart Rookie – Moving out of home

Years 9-10 – MoneySmart Rookie – Online financial transactions

Years 9-10 – MoneySmart Rookie – First job

Years 9-10 Digital activity – Shopping for a mobile

Years 9-10 Digital activity – Online shopping and banking

Year 10 Reaching goals: What’s involved?

Year 10 Mathematics – smart consumers 4 a smart future – Money matters

Years 7-10 Your Tax: Activity 4 – Calculating tax due

Years 7-10 Your Tax: Activity 5 – What other taxes do I have to pay?

Years 7-10 Business Tax: Activity 2 – Business structures

Years 7-10 Super: Activity 4 – How do I choose a super fund?

Data representation and interpretation

Calculate and interpret the mean and standard deviation of data and use these to compare data sets (ACMSP278)

Chance

Investigate reports of studies in digital media and elsewhere for information on their planning and implementation (ACMSP277)